Over 1500 key exchange locations nationwide

Airbnb In Dublin: Short-Term Rental Airbnb Regulations In 2025

If you are planning to become a short-term let Airbnb host in Dublin, Ireland, it is quite important to understand the city's regulations to stay compliant and operating successfully. These regulations are designed to address the city's unique housing challenges while allowing tourism to thrive. The truth of the matter is, having accommodation for short-term tourist letting in Dublin is regulated and acquiring a number of specific permits is crucial to be a host in thie beautiful city.

As the demand for short-term tourist lettings grows, Fáilte Ireland, the national tourism development authority of Ireland, implemented measures to ensure that the housing remains balanced and sustainable. There are 3 strict guidelines which any property hosts must adhere regarding registration, taxation, and rental limits to avoid fines or penalties.

In 2025, Airbnb regulations in Dublin focus on protecting long-term rental market availability for rent pressure zones while enhancing responsible hosting practices in property for short-term lets. By staying informed about these rules, hosts can navigate the requirements confidently and create a seamless experience for their guests staying on short-term lettings. Beyond compliance, understanding these laws also allows hosts to optimize their listings and stand out in the competitive rental market.

This guide will provide an overview of the most important the regulations for 2025 of short-term letting for tourists helping you understand what’s required to legally rent out your property and have planning guidelines used for short-term tourist lettings. From registration processes to tax obligations, knowing the details as property owners will save you time, money, and potential legal troubles for you and your short-term accommodation. Whether you’re new to hosting or a seasoned pro, staying updated on the latest rules is essential for success in the city's evolving rental landscape.

Why Airbnb Regulations Matter In Dublin

The city's housing market faces unique challenges and rental crisis making rental regulations a critical part of local governance for tourists visiting Ireland. The rules aim to:

Prevent housing shortages by limiting excessive short-term rental conversions.

Encourage responsible hosting while protecting long-term residents.

Ensure fair tax contributions from rental income.

Key Short-Term Let Airbnb Regulations For 2025

1. Registration Requirement

All hosts in the city must register their property with the local authority. The process involves:

Applying through Dublin City Council’s website.

Providing proof of property ownership or landlord permission.

Paying a registration fee, which typically ranges between €300–€500 annually.

Failure to register could result in fines or the suspension of your listing.

2. Primary Residence Rule

What Qualifies as a Short-Term Let in Dublin?

Short-term lets in city capital are stays of less than 14 days, such as those facilitated through platforms like Airbnb.

To curb housing shortages, only primary residences can be rented on a short-term basis without planning permission. Hosts can:

Rent out their property for a maximum of 90 days per year.

Host stays of no more than 14 consecutive nights per guest.

For properties not classified as primary residences, planning permission is mandatory.

For circumstances such as:

Should hosts decide to exceed the 90-day limit for short-term lettings of their PPR, they are required to seek 'change of use planning permission' from the local authority.

For short-term lettings of a Principal Secondary Residence (PSR), hosts must inform the local authority and apply for 'change of use planning permission.'

In cases where individuals are not property owners but wish to engage in short-term lettings, it is imperative to obtain consent from the legal owner of the property for such use.

You will need to notify the Dublin Council with your notification form – Form 15.

3. Taxation and Reporting

Hosts in the city must declare their rental income and pay the appropriate taxes. Different rules apply to primary and secondary residences.

Income Tax: Rental earnings are subject to Ireland’s standard income tax rates.

VAT: If your income exceeds €37,500 annually, you may need to register for VAT.

Local Property Tax (LPT): Ensure your LPT payments are up-to-date.

Keep detailed records of your earnings and expenses to simplify your tax filings.

Reporting Obligations to Irish Revenue

Airbnb is legally obligated to provide Irish host earning information to the Irish Revenue yearly. Reports include details like names, addresses, and amounts paid to hosts.

Irish Host earnings include:

All rental income earned by Irish resident Hosts in respect of both Irish and foreign listings

All rental income earned by non-Irish resident Hosts in respect of Irish listings.

The report is due by September every year and covers earnings for the previous year. If you received Irish Host earnings during the calendar year, Airbnb is required to provide Irish Revenue with the following information (which we obtain from the details in your Airbnb account):

Your first and last name

Address of your listing(s)

Your address as associated with your payout method

Amounts paid out in the reportable year, including cleaning fees

Date of your first booking during the reportable year, by listing

Due to a change to Section 888 of the Taxes Consolidation Act 1997 implemented in 2019, for periods from 1 January 2020, Airbnb is also required to provide Irish Revenue with:

Your PPSN (if an individual)/tax reference number (if a business)

The Local Property Tax ID of the property that you have listed

For details on how to find your Local Property Tax ID, please refer to the Irish Revenue website.

4. Current State of Regulations

For hosts renting their properties for short-term lets, adherence to regulations is crucial. Introduced in July 2019, these rules primarily target properties in Rent Pressure Zones (RPZs), where rents are soaring. The objective is to reclaim properties used for short-term tourist lettings and reintroduce them to the long-term rental market.

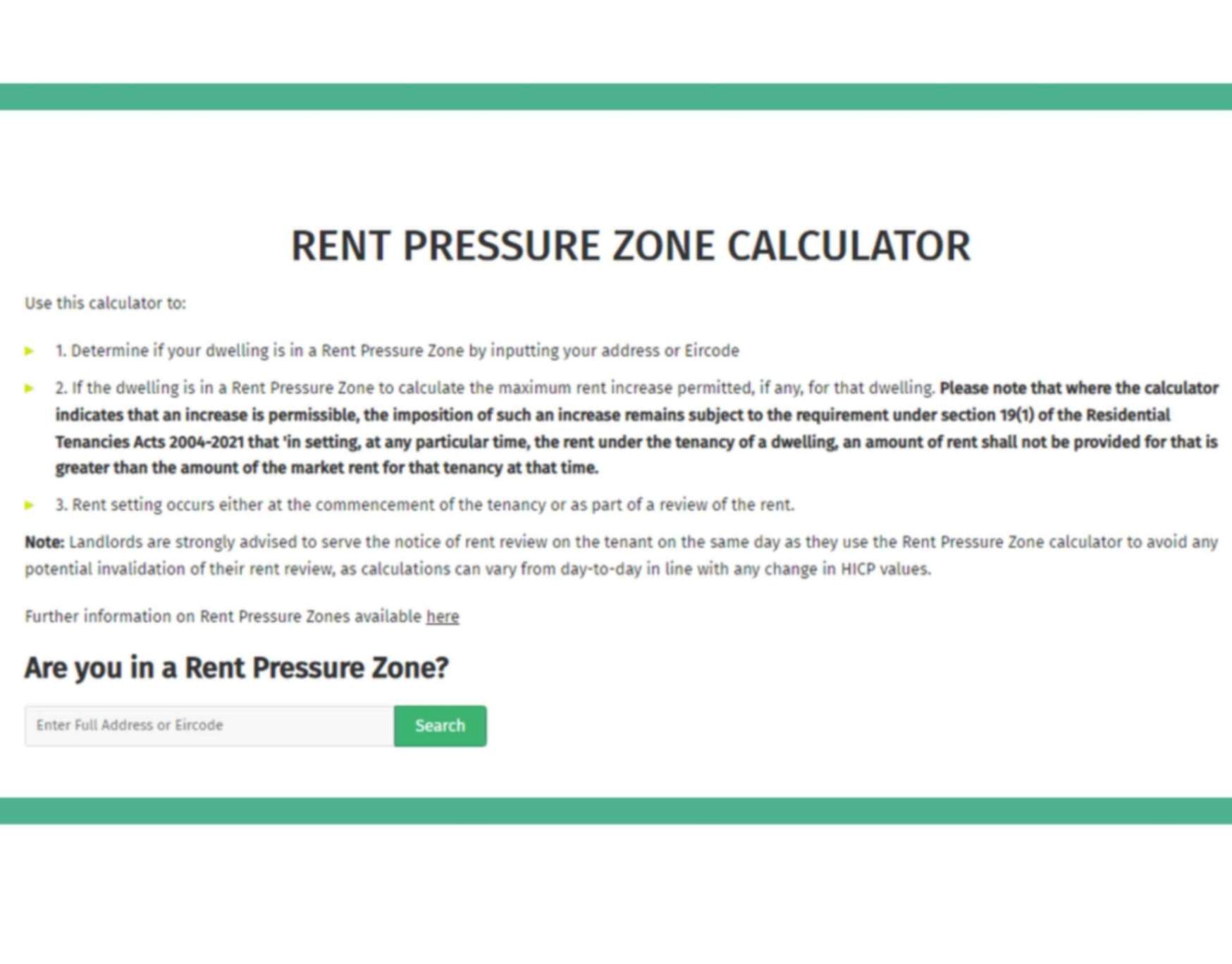

Rent Pressure Zones In Dublin

Dublin, South Dublin, Fingal County, and Dun Laoghaire-Rathdown are designated rent pressure zones. The regulations are designed to curb rising rent costs and excessive tourist rentals. Exceptions may apply, and property owners can contact local authorities for clarification.

You can check if your address falls under RPZs by using the calculator here:

Navigating Planning Permissions Of Short-Term Tourist Letting

If you wish to rent out a property that is not your primary residence, applying for and knowing the planning permission requirement is necessary. Steps include:

Submitting an Application: Detailed plans of your property, including intended usage.

Compliance Check: Ensuring your property meets zoning and housing standards.

Approval Wait Time: Decisions typically take 8–12 weeks, so plan ahead.

Properties operating without requirement for permission risk hefty fines and enforcement actions if hosts do not register with the planning authority.

The Planning and Development Act of 2000 is a key piece of legislation in Ireland that governs the country's planning and development system. It provides the framework for how land use and development are managed, ensuring sustainable growth while balancing environmental, social, and economic interests. The act has been amended several times to adapt to evolving needs, but its core objectives remain consistent.

Ireland's Planning And Development Act Of 2000

Development Plans:

-Every local authority in Ireland is required to create a development plan outlining land-use policies and objectives for their area, typically covering a six-year period.

-These plans guide decisions on planning applications and zoning.

Planning Permissions:

-Individuals or businesses must apply for planning permission for most construction or development projects.

-The act specifies the process for submitting applications and the criteria for approvals or rejections.

Environmental Protection:

-The act integrates environmental considerations into planning decisions, including requirements for Environmental Impact Assessments (EIAs) for significant developments.

Sustainable Development:

-It emphasizes sustainable land use, promoting balanced growth while protecting natural and cultural resources.

Enforcement Powers:

-Local authorities are empowered to enforce planning laws, including addressing unauthorized developments through fines or legal actions.

Special Areas of Conservation and Heritage:

-The act includes provisions for protecting areas of environmental importance and cultural heritage.

Public Participation:

-Members of the public can submit observations or objections to planning applications and contribute to the drafting of development plans.

Strategic Development Zones (SDZs):

-SDZs are designated areas prioritized for development, with streamlined planning processes to encourage investment and infrastructure projects.

Relevance of the Act

The Planning and Development Act 2000 is essential for ensuring that Ireland’s growth aligns with long-term goals, addressing challenges like urbanization, housing shortages, and environmental conservation. It sets the legal groundwork for all construction and land-use activities, ensuring transparency, public involvement, and adherence to best practices.

This legislation is critical for property developers, local authorities, businesses, and individuals planning to build, expand, or modify properties in Ireland.

When Is Planning Permission Required For Term Letting?

To host short-term lets, planning permission is crucial. Here's a breakdown:

Principal Property: No planning permission needed for short-term rentals less than 90 days a year.

Beyond 90 Days: Planning permission required for longer rentals in the principal property.

Second Property: Planning permission always required for any short-term let.

Exemptions From Planning Permission

Exempt from the planning permission include being outside RPZs, letting for 15 days or more, existing planning permission, corporate/executive lets, rent-a-room scheme, and purpose-built student accommodation. Click here to read a full list.

Need To Apply For Planning Permission in Dublin

Hosts must fill in a planning form available on the local authority's website and submit it with required documents. The process takes about 8 weeks.

Tips For Airbnb Hosts In Dublin

1. Stay Updated

Local regulations can change. Subscribe to updates from Dublin City Council or Airbnb to stay compliant.

2. Offer a Great Experience

While following the rules is crucial, providing an exceptional guest experience can make your listing more attractive. Focus on:

Cleanliness and amenities.

Prompt communication with guests.

Highlighting local attractions in your listing.

3. Collaborate with Professionals

Hire a property manager or legal consultant if you’re unsure about the regulations. This investment can save you time and potential legal issues.

In Retrospect

Understanding and adhering to planning rules of Airbnb regulations in Dublin is essential for running a successful and compliant short-term rental. By registering your property, respecting the primary residence rule, and staying on top of tax obligations, you can thrive as a host in 2025.

If you’re looking for more tips and updates on Airbnb hosting in Dublin, bookmark this guide and check back often for the latest news!

About Us: KeyNest

It is vital for any hosts to sustain an efficient key management access to ensure your listing gets maintained in the Airbnb platform. That is why KeyNest, a leading smart key exchange service, is designed to simplify and secure the management of listing access for hosts, property managers, and guests. With a network of thousands of partner locations worldwide, KeyNest ensures that keys are safely stored and easily accessible 24/7, providing a seamless solution for short-term rental hosts, including those on platforms like Airbnb.

Want to know more about KeyNest?

KeyNest offers you a convenient service for storing and exchanging your property keys. You can drop off a key at any of the 7,000+ locations in our network, so there’s one such Point located next to your property

KeyNest integrates seamlessly with popular booking platforms, enabling automated key handovers and instant notifications when keys are collected or returned. Whether managing one listing or a portfolio of listings, KeyNest is a reliable partner for managing access, saving time, and improving guest experiences.

Guests, cleaners or contractors can then collect the key securely from a KeyNest Point or KeyNest Locker which is usually open 24/7. You'll be notified each time the key is picked up or returned, and you can even customize check-in and check-out times. By leveraging technology and a global network of locations, KeyNest continues to redefine listing management, offering solutions tailored to meet the evolving needs of the listing market.

KeyNest has an ever-expanding global network of locations located just minutes from your property. Let us know to find out more and contact us.

Neil Beltran 7 December 2024